E-Invoicing

We are enabling the existing systems for E-Invoicing and streamlining the invoice management by simplifying and showcasing how invoice and compliance documents work together. Invoicing solutions help achieve new levels of invoicing and contribute to reducing the risk of invoice errors and exceptions. To be specific it is more about losing the paper and going digital .

According to the law, an electronic invoice is an invoice generated and stored in a structured electronic system with all the tax invoice requirements. It Increases the accuracy of invoices to speed up both processing and payments.

The e-invoicing provisions will apply to all taxable goods and services that are subject to VAT (whether standard or zero rates).

All VAT-registered business owners (except non-resident taxable people) within KSA who make sales within and outside KSA have to adopt the e-invoicing process.

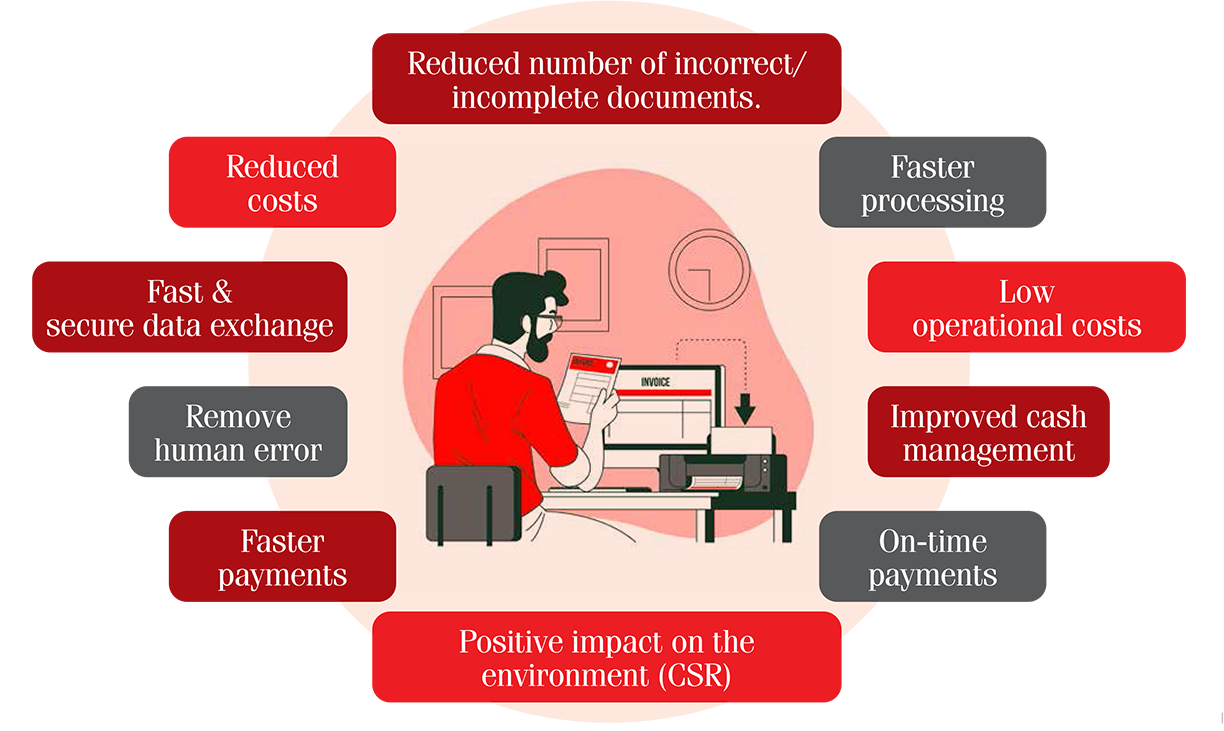

The Key Benefits of the Service involve:

Our E-Invoicing Solution can be best suited for your business as we are the finest providers of

- Custom Solution

- Expert Support Team

- Data Security

- Validation Of Data

- Seamless Integration with ERP etc.

The bTranz approach in the latest E-Invoicing process implicates on

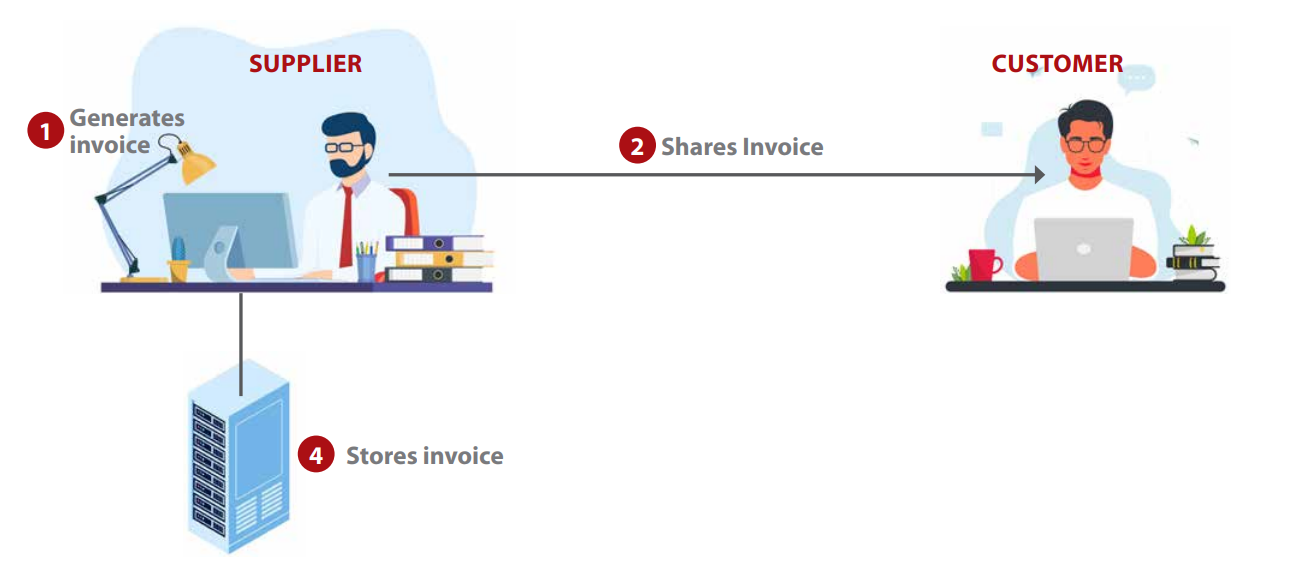

Phase 1:

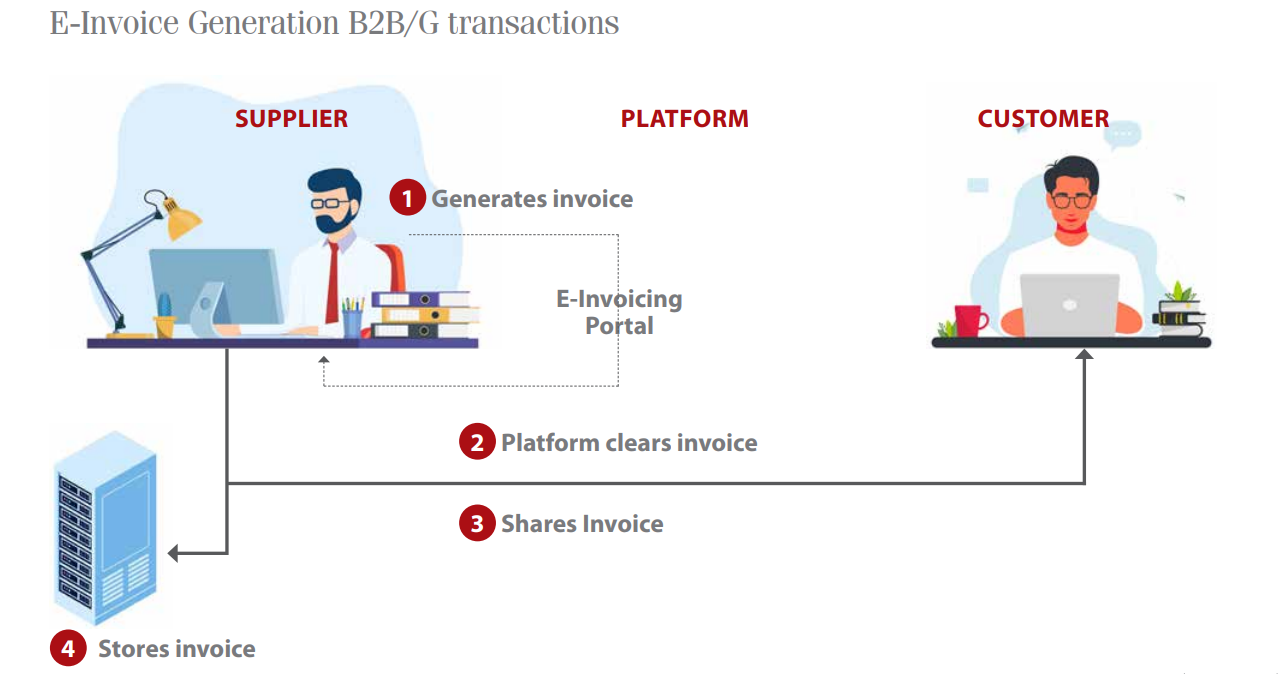

Phase 2: